C+ ’s Report on Vietnam FDI in 3Q of 2025: Strong Growth Momentum and Continued Policy Reforms

On October 28, C+ Consult. published its quarterly report on Vietnam foreign-direct-investment (FDI) in first three quarters of 2025.

Amid a global slowdown in foreign direct investment (FDI) and ongoing U.S.–China trade tensions, Vietnam has emerged as Asia’s growth bright spot. The country’s GDP was reported to grow by over 7.8% in the first nine months of 2025, marking its second-highest growth rate in a decade.

Overview of Vietnam ‘s FDI in 3Q 2025: Steady and Positive Growth

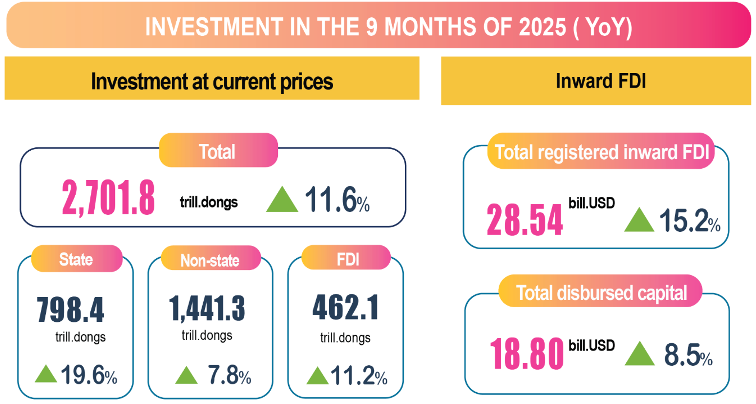

According to data from the General Statistics Office (Ministry of Finance), as of September 30, 2025, total registered foreign investment in Vietnam — consisting of newly registered capital, adjusted capital, and capital contributions/share purchases — reached USD 28.54 billion, representing a 15.2% year-on-year increase. Among these, 2,926 new projects were granted investment licenses, up 17.4% from the same period last year.

While newly registered capital saw a slight decline of 8.6%, totaling USD 12.39 billion, adjusted capital surged 48% to USD 11.3 billion, and capital contributions and share purchases rose 35% to USD 4.8 billion. This reflects sustained foreign investor confidence and optimism toward Vietnam’s stable and improving business environment.

Notably, disbursed FDI hit a five-year high, reaffirming Vietnam’s resilience and attractiveness as an investment destination. The manufacturing and processing sector continued to play a leading role, accounting for 82.8% of total disbursed capital (approximately USD 15.56 billion), underscoring its position as the backbone of Vietnam’s economy.

Key Legal and Policy Updates in Q3/2025

During the third quarter of 2025, the Government and relevant authorities introduced several important legislative and regulatory updates aimed at strengthening the investment and business landscape. These include:

- Law on Investment (Amended) – Law No. 90/2025/QH15 (effective July 1, 2025): Introduces new provisions to promote innovation, digital transformation, and technological infrastructure development.

- Decree No. 236/2025/NĐ-CP (effective October 15, 2025): Provides detailed guidance on the implementation of the Global Minimum Tax, helping prevent base erosion and profit shifting.

- Corporate Income Tax Law 2025 – Law No. 67/2025/QH15 (effective October 1, 2025): Aims to modernize Vietnam’s tax framework, enhance transparency, and align with international standards.

- Decree No. 239/2025/NĐ-CP (issued September 3, 2025): Amends and supplements Decree No. 31/2021/NĐ-CP, guiding the implementation of the Investment Law.

- Decision No. 36/2025/QĐ-TTg (effective November 15, 2025): Issues the updated Vietnam Standard Industrial Classification System, expanding from 21 to 22 industries.

C+ Consult. ’s Investment Promotion Activities

In line with Ho Chi Minh City’s dynamic investment promotion agenda, C+ Consult actively participated in and co-organized multiple programs and business missions both domestically and abroad, including:

- Participation in the 7th Ho Chi Minh City – Hyogo (Japan) Economic Forum (August 5, 2025)

- Attendance at the Vietnam–Singapore and Vietnam–Malaysia Business Roundtable Conferences (August 29–30, 2025) as part of the city’s investment promotion delegation

- Organization and coordination of a Chinese business delegation visiting Ho Chi Minh City and the Mekong Delta region to explore investment opportunities and foster bilateral cooperation

Should you need the full report, register below to download

Vietnam FDI Report 3Q/2025

Leave a Reply