Vietnam’s Surge in Foreign Direct Investment (FDI) in the First Five Months of 2025

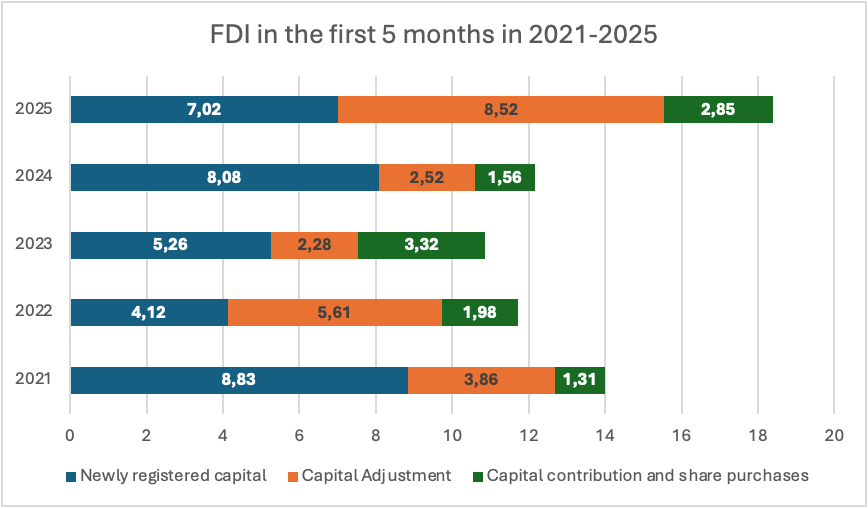

Vietnam’s economy has shown a remarkable surge in Foreign Direct Investment (FDI) in the first five months of 2025. The total amount of registered FDI reached a record-breaking figure of $18.4 billion, marking a significant 51% increase compared to the same period in 2024.

Growth in FDI Projects and Capital

A key driver of this surge is the significant increase in the number of newly licensed foreign-invested projects, with around 1,549 new projects registered during this period. While the number of new projects showed a healthy 14% increase year-on-year, the registered capital for these projects amounted to more than $7 billion, a slight decrease of 13.2% compared to the previous year.

However, the overall picture remains positive, with the total amount of foreign capital being funneled into the economy showing robust growth. The country also witnessed a marked increase in capital adjustments, with 672 existing projects registering additional capital, which totaled $8.51 billion. This figure is an impressive 3.4 times higher than the same period last year.

Moreover, foreign investors continued to engage in capital contributions and share purchases, with over $2.85 billion spent through 1,358 such transactions, a 1.8-fold increase from 2024. This indicates a deepening level of commitment from foreign investors who not only establish new projects but also enhance and expand existing investments.

FDI Disbursement and Utilization

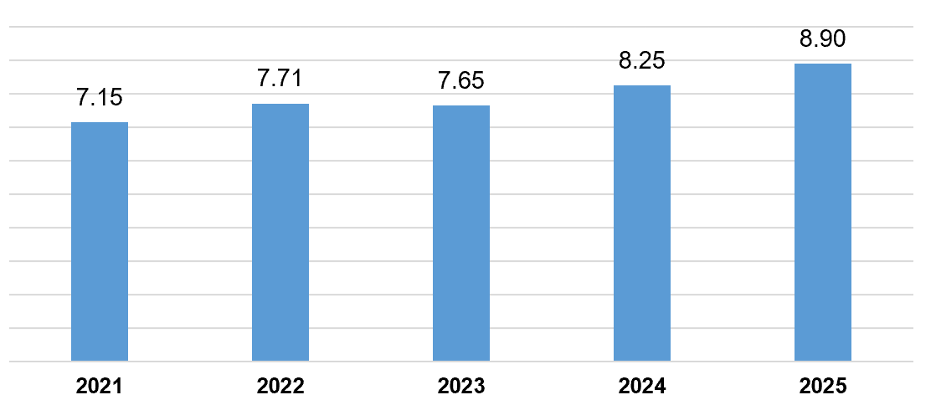

Vietnam has also seen a noticeable improvement in FDI disbursements, which reached approximately $8.9 billion, marking a 7.9% increase from the same period in 2024. This represents the highest disbursement in the past five years, indicating that foreign capital is being effectively utilized to foster growth in the country’s key economic sectors. The efficient allocation and use of this FDI have been crucial to maintaining the momentum of Vietnam’s economic development. These investments have not only brought in capital but also advanced technology, skills, and management practices that will benefit the country in the long run.

Sectoral Distribution of FDI

Manufacturing remains the dominant sector attracting FDI, accounting for over 56.5% of total foreign investment. The manufacturing and processing sector received an investment of more than $10.39 billion, showing a 32% year-on-year increase. This continued interest in manufacturing is largely driven by Vietnam’s competitive labor force, the growing demand in the domestic market, and the country’s integration into global supply chains.

The automotive, electronics, and textiles industries have been particularly favored by foreign investors, as Vietnam continues to build its capacity to meet the demands of these high-value industries. The country’s efforts to attract high-tech industries have also borne fruit, with the electronics sector being a major recipient of FDI.

In addition to manufacturing, the real estate sector saw a considerable rise in foreign investment, attracting nearly $5 billion, which is more than double the amount registered in the same period last year. The rapid urbanization and growing demand for housing, commercial properties, and infrastructure have made the real estate sector an attractive area for foreign investors.

Emerging Sectors: Science, Technology, and Retail

Science and technology also attracted notable investments, amounting to over $1 billion. This signals that Vietnam is becoming an important hub for technological innovation in the region, as foreign investors look to capitalize on the country’s emerging tech ecosystem. Sectors such as information technology, telecommunications, and software development are gaining prominence, which could lay the foundation for further digital transformation in Vietnam’s economy.

Additionally, the wholesale and retail sector also garnered significant foreign interest, with more than $596.8 million being invested. This indicates that Vietnam’s growing consumer market, which is increasingly affluent and tech-savvy, is an appealing target for foreign retail businesses looking to establish a presence in Southeast Asia.

Top Foreign Investors in Vietnam

FDI in Vietnam is not only coming from traditional investors like Japan, South Korea, and Taiwan but also from new players such as Singapore and China. Singapore continues to be the largest source of FDI, contributing $4.38 billion, which accounts for about 23.8% of the total FDI in the first five months of 2025. This marks a 30.1% increase year-on-year. South Korea is the second-largest investor, with $2.93 billion, nearly 16% of the total FDI, representing a remarkable 147% increase year-on-year.

Other countries, such as China, Japan, and Malaysia, have also significantly contributed to Vietnam’s FDI inflows. This growing diversity in FDI sources reflects Vietnam’s broadening appeal to investors across the globe.

Regional Distribution of FDI

Geographically, FDI has been spread across various provinces and cities in Vietnam, with notable investments concentrated in Hanoi, Ho Chi Minh City, and Bac Ninh. Hanoi, the capital, has attracted over $3.2 billion, representing 17.6% of the national total. This figure is nearly three times higher than last year’s, underscoring the city’s strategic position as a political and economic center. Bac Ninh, known for its high-tech manufacturing facilities, particularly in electronics, has secured $2.7 billion in FDI, which accounts for 14.8% of total foreign investment. Ho Chi Minh City, the economic powerhouse of the south, attracted $2.58 billion, or 14.1% of the total. These cities have become focal points for foreign investors looking to tap into the growing domestic market and take advantage of Vietnam’s increasing connectivity within the region.

Outlook for FDI in Vietnam

Looking ahead, the outlook for FDI in Vietnam remains positive, with continued government efforts to improve the investment environment, enhance infrastructure, and encourage innovation. The Vietnamese government’s commitment to ensuring a transparent and efficient regulatory framework, coupled with a workforce that is young, dynamic, and increasingly skilled, positions the country as a top destination for foreign investment in Southeast Asia. The growing importance of trade agreements, such as the EU-Vietnam Free Trade Agreement (EVFTA) and the Regional Comprehensive Economic Partnership (RCEP), further strengthens Vietnam’s appeal as a key player in global trade.

Source: Various sources

Pingback: VIETNAM FDI H1/2025: the Highest Figure in Five Years